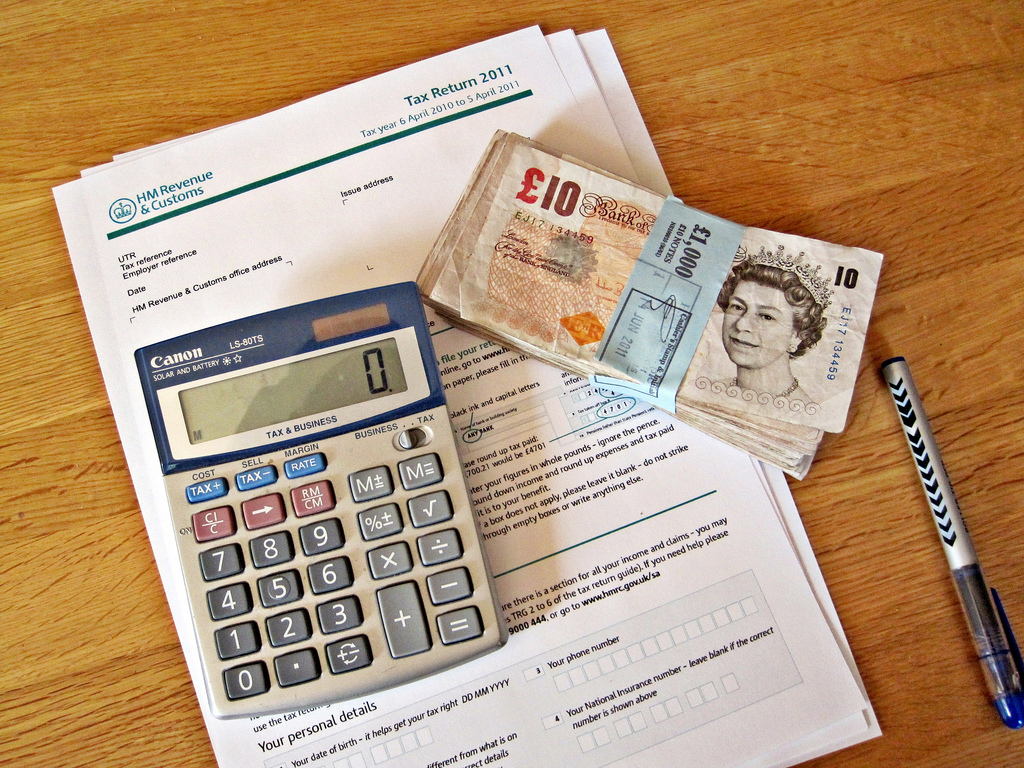

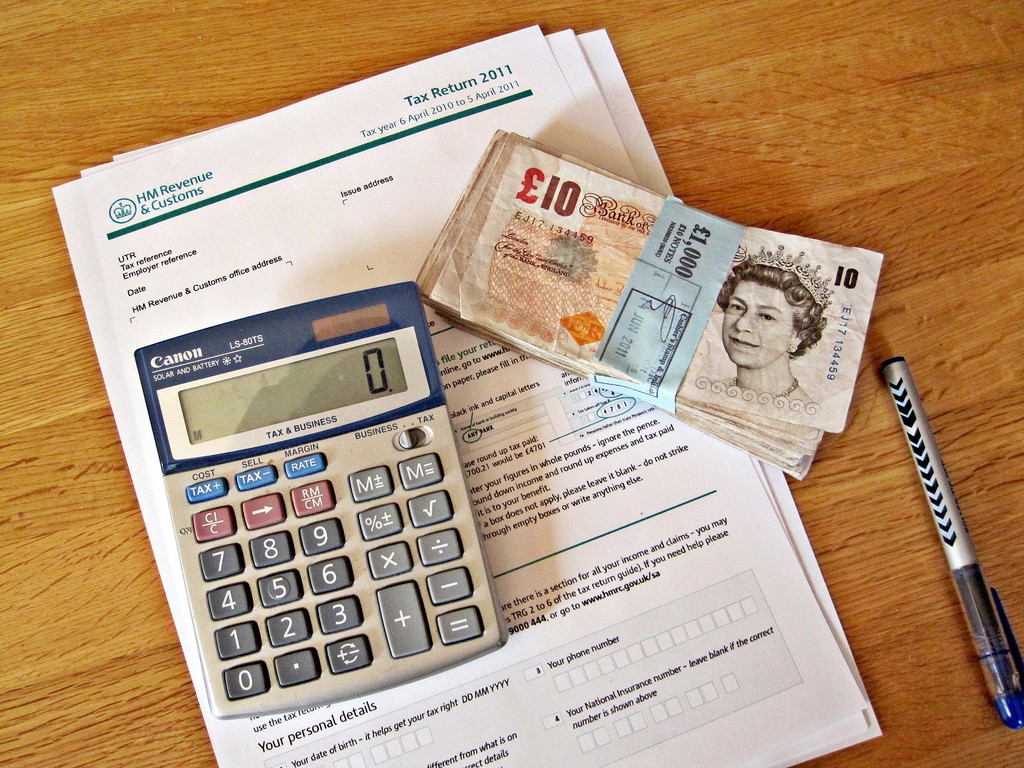

While there are many advantages of being self-employed, a downside is dealing with tax! Let’s face it; nobody like paying tax unless they have to do so. Plus, it can sometimes be a nightmare navigating the complex tax laws that we have here in the UK.

HMRC do have some help and advice on their website regarding business taxes. They also have a helpline you can call, although it’s always tough getting through to someone! With those points in mind, you might feel like you’re on your own when it comes to taxation and accounting.

Let me stop you right there because there is ALWAYS help out there if you need it! If you’re new to sole trader accounts and can’t get your head around tax rules, you’ve come to the right place.

Keep reading, and I will share with you some dynamite ways to understand how a business gets taxed. Plus, I will give you some quick tips on how to keep your tax affairs in order. Here is what you need to know:

Your business is a separate entity to you

It doesn’t matter if you are just a sole trader or you run a limited company. It’s important to note that your business is a separate ‘thing’ to you. It must have its own identity and bank account. Otherwise, you could end up making things complicated!

It’s crucial that you keep that point in mind. Doing so will make it easier to deal with your accounts and tax returns.

Always keep records of ALL financial transactions

Even if you spend money buying a book of first class stamps, keep records of everything you buy and sell! When it comes to filling in your tax return, you need accurate turnover, profit and loss figures.

Remember that you can claim most outgoings as business expenses. HMRC even gives you an ‘allowance’ if you work from home to help you reduce your tax bill!

What happens if you don’t keep proper records of all your financial transactions, I hear you ask? Well, you’ll find it hard to balance your books, and you’ll make mistakes on your tax returns.

If bookkeeping isn’t your strong point, pay someone else to do it for you. Trust me; it’s a worthwhile business expense! If you’re worried about cost, there are many fixed price accountants out there. That means you don’t have to deal with increased future costs for your bookkeeping!

Use technology to help you manage your accounts

When you do work for someone, you will naturally want to get paid for your services. The standard thing to do is issue an invoice to your customers for services rendered.

Did you know you can use computer software and even smartphone apps for that purpose? What’s more, many solutions offer other accounts help. Examples include expense tracking, tax calculations and more. The solutions available are affordable and easy to use. And your accountant or bookkeeper will be happy too!

Know about the different types of tax

Last, but not least, you should ensure you know about and pay the right taxes for your business. As a sole trader, you will only have to worry about income tax and national insurance. If you run a company, there is also corporation tax and VAT to consider.

Sometimes, it might be more tax-efficient for you to be a limited company. Talk to an accountant to find out what’s best for you. Good luck!

Leave a Reply